Post by: Vansh Kumar

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. It is used by lenders, banks, and financial institutions to assess how likely you are to repay borrowed money. The higher your credit score, the better your chances of securing loans with favorable interest rates. Your credit score serves as a key factor in determining financial opportunities and stability, making it crucial to understand how it works and how to maintain a good score.

Several factors determine your credit score, each carrying a different weight in the calculation. Payment history, which accounts for 35% of your score, is one of the most important factors. Making timely payments positively impacts your score, while late or missed payments can significantly lower it. Credit utilization, which makes up 30% of your score, refers to the ratio of your credit card balances to your credit limits. Lower utilization is better for your score as it shows responsible credit management. The length of your credit history contributes 15% to your score, with longer credit histories being more favorable as they provide lenders with more data on your borrowing habits. The types of credit you have account for 10% of your score, as a mix of credit accounts, such as credit cards, auto loans, and mortgages, can contribute to a healthier score. Lastly, new credit inquiries make up the remaining 10%, as opening multiple new credit accounts within a short time frame may negatively impact your score.

Your credit score has a significant impact on many aspects of your financial life. One of the most immediate effects is on loan and credit card approvals. A good credit score increases your chances of getting approved for loans and credit cards, as lenders are more likely to offer financial products to individuals with higher scores because they are deemed lower risk. Additionally, your credit score influences interest rates and loan terms. A high credit score allows you to secure loans with lower interest rates, meaning you will pay less in interest over time, making it easier to manage your finances. Renting a home can also be affected by your credit score, as many landlords check credit scores before renting out their properties. A low score could result in higher security deposits or even rejection. Employment opportunities may also be influenced by your credit score, as some employers review credit scores as part of their hiring process, especially for roles involving financial responsibilities. A poor score might affect your job prospects. Furthermore, insurance premiums are often determined based on credit scores, with lower scores leading to higher insurance costs.

If your credit score is not where you want it to be, there are several steps you can take to improve it. One of the most effective ways to boost your score is by making on-time payments, as timely bill payments positively influence your credit rating. Reducing credit utilization is also crucial, and it is advisable to aim to use less than 30% of your total available credit. Avoiding opening too many accounts at once is another key strategy, as applying for multiple credit accounts in a short period can lower your score. Monitoring your credit report regularly can help you identify and dispute any errors that may be negatively impacting your score. Additionally, maintaining old credit accounts can positively impact the length of your credit history, further improving your score.

A credit score is a key financial metric that influences loan approvals, interest rates, and financial opportunities. It is calculated based on payment history, credit utilization, credit history length, types of credit, and new credit inquiries. A good credit score leads to lower interest rates, better loan terms, and improved rental and job prospects. To improve your score, make on-time payments, reduce credit utilization, avoid excessive new accounts, monitor your credit report, and maintain older credit accounts. Managing your credit wisely ensures long-term financial stability and greater financial freedom.

The information provided in this article is for educational purposes only. Readers are encouraged to seek professional financial advice before making any major financial decisions. – DXB News Network

#trending #latest #CreditScore #FinancialHealth #ImproveCredit #MoneyTips #BetterFinances #CreditScoreTips #LoanApproval #FinancialSuccess #ManageCredit #BoostCredit #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

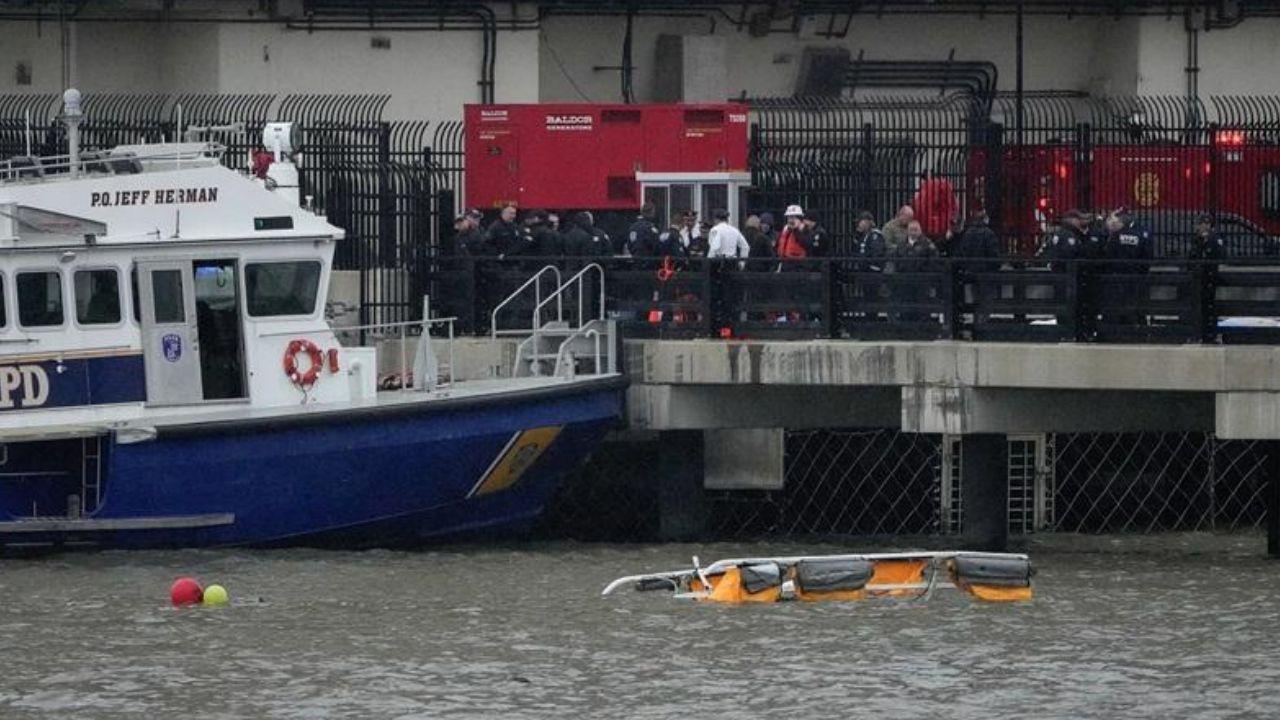

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc