Post by: Vansh Kumar

As we approach 2025, many investors are looking for ways to grow their wealth while minimizing risk. In a world of financial uncertainty, low-risk investments have become increasingly popular. Whether you’re saving for retirement, building an emergency fund, or just looking to make your money work harder, it’s essential to explore safe investment options.

In this article, we’ll guide you through the Top 11 Low-Risk Investments for 2025: Safest Choices that can help secure your financial future. These investments balance safety with growth potential, allowing you to sleep easy at night while still enjoying modest returns.

A high-yield savings account is one of the safest places to park your money. These accounts offer interest rates higher than traditional savings accounts, which helps you keep up with inflation. While the returns may not be massive, the security of knowing your money is safe is worth it for many investors.

Why it’s safe: High-yield savings accounts are typically insured by the government up to a certain limit, making them a risk-free option for conservative investors.

Certificates of Deposit (CDs) are a great way to earn guaranteed returns with minimal risk. When you invest in a CD, you agree to lock your money away for a set period, ranging from a few months to several years, in exchange for a higher interest rate than a regular savings account.

Why it’s safe: CDs are insured by the FDIC (Federal Deposit Insurance Corporation) for up to $250,000 per depositor, per bank, which makes them a reliable low-risk option.

Government bonds are issued by national governments and are considered one of the safest investment options available. U.S. Treasury bonds, in particular, are widely regarded as risk-free because they are backed by the U.S. government.

Why it’s safe: The likelihood of the government defaulting on these bonds is incredibly low, which makes them a secure investment for those looking for stable returns.

Municipal bonds are issued by local governments, such as cities or states. These bonds are typically used to fund public projects, and they offer relatively low-risk returns. Many municipal bonds also provide tax-free income, which can be a great benefit for certain investors.

Why it’s safe: Since they are backed by government entities, municipal bonds offer a higher level of security compared to corporate bonds, making them an attractive option for conservative investors.

Index funds are a popular investment choice for those looking for low-risk, long-term growth. These funds track a broad market index, such as the S&P 500, providing diversification and reducing risk. While they can fluctuate with the market, they tend to offer steady, long-term growth.

Why it’s safe: The diversification of index funds reduces the risk of significant losses, making them a safer choice than investing in individual stocks.

Dividend-paying stocks are a low-risk way to earn steady income while still participating in the stock market. These stocks belong to well-established companies with a history of paying dividends to shareholders. While stock prices may fluctuate, the dividend payments provide regular income, even during market downturns.

Why it’s safe: Companies that pay dividends are often financially stable, which makes them less volatile than growth stocks. However, it's essential to research the company’s financial health before investing.

Real Estate Investment Trusts (REITs) allow you to invest in real estate without owning property directly. These trusts own and manage a portfolio of properties and pay dividends to investors. While REITs can experience market fluctuations, they tend to provide a steady stream of income.

Why it’s safe: REITs offer diversification in the real estate market, making them less risky than owning individual properties. Many REITs also focus on high-quality properties, further reducing risk.

Robo-advisors are automated investment platforms that use algorithms to manage your investments based on your risk tolerance. These platforms often focus on low-risk investments, such as index funds and bonds, and are a convenient way to build a diversified portfolio without the need for in-depth knowledge of investing.

Why it’s safe: Robo-advisors are designed to minimize risk by diversifying your portfolio across various asset classes, which can help you achieve consistent returns without taking on too much risk.

Treasury Inflation-Protected Securities (TIPS) are government bonds designed to protect investors from inflation. The principal value of TIPS increases with inflation, ensuring that your investment maintains its purchasing power over time.

Why it’s safe: TIPS are backed by the U.S. government and are specifically designed to mitigate inflation risk, making them an excellent choice for conservative investors concerned about rising prices.

Stable value funds are low-risk investment options that are often found in employer-sponsored retirement plans, such as 401(k)s. These funds invest in high-quality, short-term bonds and provide a stable return with minimal risk of loss.

Why it’s safe: Stable value funds are designed to offer safety and stability, providing consistent returns without the risk of market volatility.

Investing in precious metals, such as gold and silver, can provide a hedge against inflation and economic downturns. While the price of precious metals can fluctuate, they have historically maintained their value over the long term.

Why it’s safe: Precious metals have intrinsic value and tend to perform well in times of economic uncertainty, making them a safe choice for those looking to preserve wealth.

The Top 11 Low-Risk Investments for 2025 provide safe and reliable options for individuals looking to grow their wealth with minimal risk. This article highlights several investment avenues that ensure security while offering consistent returns. These include high-yield savings accounts, government bonds, municipal bonds, index funds, and dividend-paying stocks. Additionally, options like Real Estate Investment Trusts (REITs), robo-advisors, Treasury Inflation-Protected Securities (TIPS), stable value funds, and precious metals are also explored. Each of these investments offers varying levels of protection against economic uncertainty and inflation, allowing investors to build wealth with confidence. The key takeaway is that by diversifying across these low-risk investments, individuals can safeguard their financial future while still enjoying steady growth.

The information provided in this article is for general informational purposes only and should not be construed as financial advice. Always consult with a qualified financial advisor or investment professional before making any financial decisions. DXB News Network does not endorse or recommend any specific investment strategies or products.

#trending #latest #Top11LowRiskInvestments #SafeInvestments2025 #FinancialSecurity #LowRiskInvesting #InvestmentOptions #WealthBuilding #SmartInvestments #RiskFreeInvesting #SecureYourFuture #FinancialPlanning #InvestingIn2025 #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

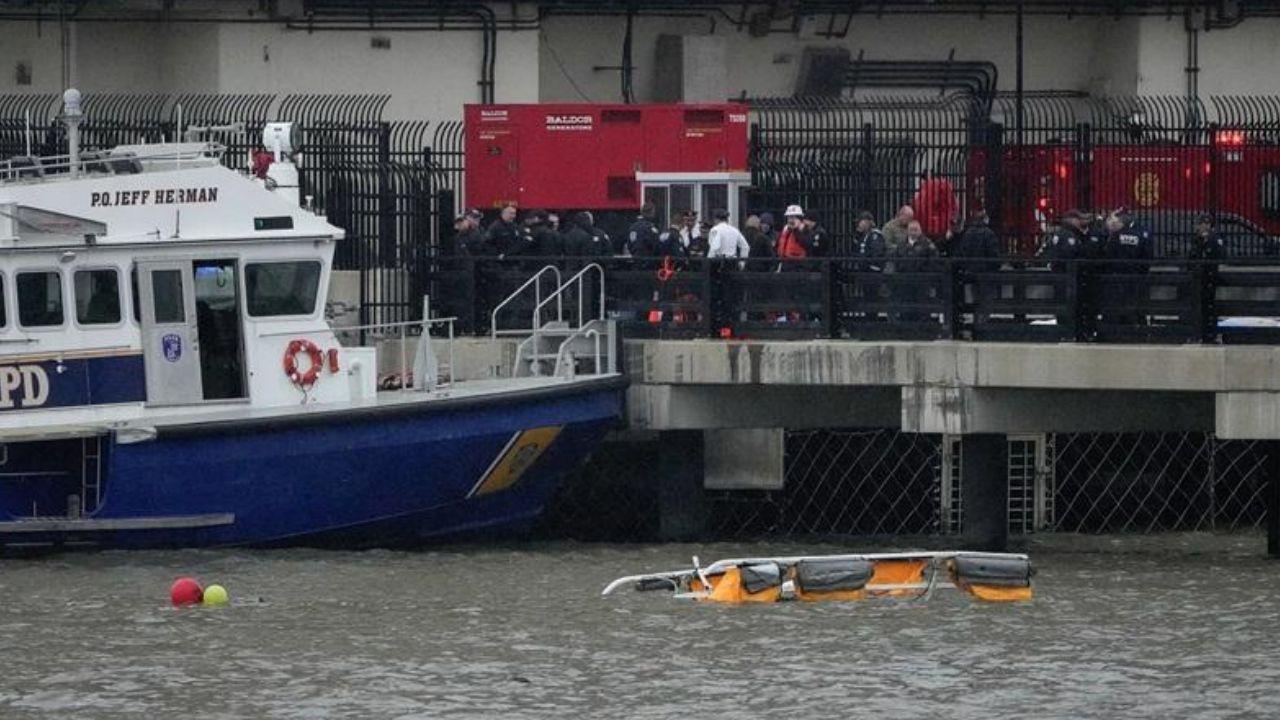

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc