Post by: Bandan Preet

Equity financing and Initial Public Offerings (IPOs) are buzzing topics in the financial world. But what do these terms mean, and why are they making waves? Let’s dive into the world of equity financing and IPOs, unravelling what’s new and why it matters. Whether you’re a budding entrepreneur, an aspiring investor, or just curious, this guide will simplify it for you.

What Is Equity Financing?

Equity financing is a way for companies to raise money by selling ownership stakes, or shares, to investors. Unlike loans, this method does not require repayment. Instead, investors receive a share of the profits and a say in the company’s decisions.

For example, imagine you start a bakery and need more funds to expand. Instead of borrowing from a bank, you sell part of your bakery’s ownership to someone who provides the money. That’s equity financing!

What Are IPOs?

An Initial Public Offering (IPO) is when a private company decides to go public by selling its shares to the general public for the first time. This process allows the company to raise substantial funds while giving regular investors the chance to own a piece of it.

Think of an IPO as a company’s big debut in the stock market—like a star walking the red carpet for the first time. Once a company goes public, its shares are traded on stock exchanges, making it more accessible to everyday investors.

Why Are Equity Financing and IPOs Important?

Equity financing and IPOs are crucial for businesses and the economy. They help companies:

For investors, equity financing and IPOs offer opportunities to:

What’s New in Equity Financing?

The world of equity financing is evolving, thanks to modern technology and changing regulations. Here are some of the latest trends:

1. Crowdfunding and Online Platforms

Crowdfunding platforms like Kickstarter and Indiegogo have made equity financing more accessible. Startups and small businesses can now pitch their ideas online to attract investors from around the world. This method democratizes equity financing, allowing even small investors to participate.

2. ESG Investments

Environmental, social, and governance (ESG) factors play a bigger role in equity financing. Companies with sustainable practices are attracting more investors who prioritize ethical and green initiatives.

3. Blockchain and Tokenization

Blockchain technology is transforming equity financing. Tokenization allows companies to issue digital tokens that represent ownership shares. These tokens can be traded on blockchain platforms, making the process more efficient and transparent.

4. Private Equity Growth

Private equity firms are investing more in high-potential startups, offering an alternative to traditional equity financing. These firms often provide mentorship along with funding, helping businesses scale rapidly.

IPOs have also seen exciting developments. Here’s what’s new:

1. SPACs (Special Purpose Acquisition Companies)

SPACs, or blank-check companies, are a new way for businesses to go public. These companies raise funds through an IPO with the sole purpose of acquiring another company. SPACs have gained popularity because they simplify the IPO process and offer flexibility.

2. Direct Listings

Some companies are bypassing traditional IPOs and opting for direct listings. In this approach, a company’s shares are directly listed on the stock exchange without the need for underwriters. This method is often quicker and less expensive.

3. Tech Dominance

The tech industry continues to dominate IPO activity. Companies in artificial intelligence, e-commerce, and fintech are attracting significant attention from investors.

4. Retail Investor Participation

Retail investors—regular people like you and me—are playing a bigger role in IPOs. Thanks to online trading platforms, participating in IPOs has become easier and more affordable.

The Risks Involved

While equity financing and IPOs offer great opportunities, they also come with risks:

If you’re new to the world of equity financing and IPOs, here are some tips:

Equity financing and IPOs are powerful tools that drive innovation, growth, and investment opportunities. With exciting developments like crowdfunding, blockchain, and SPACs, this field is more dynamic than ever. While there are risks, understanding the basics and staying informed can help you make smarter decisions.

Whether you dream of starting your own company or investing in the next big thing, equity financing, and IPOs are doors to exciting possibilities. So, keep learning and exploring—who knows, you might be the next big name in finance!

Equity financing and IPOs are essential for businesses seeking growth and for investors looking for new opportunities. Equity financing involves raising funds by selling ownership stakes, while IPOs allow private companies to go public. Recent trends include crowdfunding, blockchain technology, SPACs, and ESG-focused investments. While these methods open up exciting opportunities, they also come with risks. By staying informed and starting small, both businesses and investors can navigate this dynamic financial landscape.

This article is intended for informational purposes only and does not constitute financial advice. Readers are encouraged to consult financial experts or conduct thorough research before making investment decisions. DXB News Network is not responsible for any financial outcomes resulting from actions taken based on this article.

#trending #latest #EquityFinancing #IPOs #BusinessGrowth #InvestingTips #FinancialTrends #Crowdfunding #Blockchain #StockMarket #ESGInvestments #SPACs #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

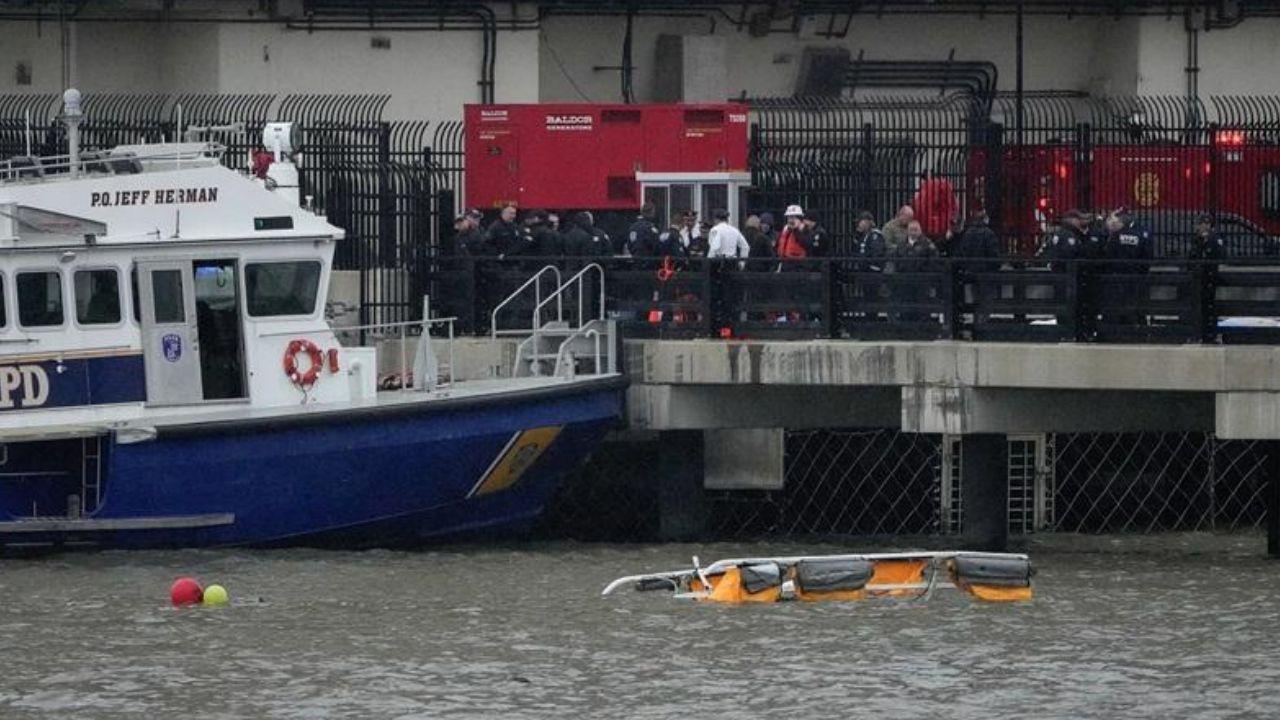

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc