Post by: Bandan Preet

Photo: WAM

Dubai's investment firm, Shuaa, has taken an important step to buy more time for its much-needed restructuring. The company’s Board of Directors has approved the issuance of two ‘Mandatory Convertible Bond’ (MCB) tranches, worth a combined total of Dh425.5 million. This move will provide more clarity to Shuaa’s management, shareholders, and lenders about what to expect soon.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

The first tranche, worth up to Dh150 million, will be offered to current Shuaa shareholders through a private placement. This will come with a mandatory conversion into shares at Dh0.32 per share. The second tranche, worth Dh275.5 million, will be given to holders of previous bonds issued by a Shuaa-related Special Purpose Entity (SPE). It will also have the same conversion terms.

Both tranches of bonds will be converted into shares as soon as possible after they are issued. This reflects Shuaa’s commitment to completing its restructuring process as quickly as possible.

Shuaa’s stock on the Dubai Financial Market (DFM) will open at Dh0.24, an increase of more than 4.5% from Friday.

The company has taken some time to finalize the details of this convertible bond program. But now that the plan is in place, Shuaa can focus on improving its operations and rebuilding its financial strength, according to market analysts.

In other news, Shuaa’s Managing Director, Ahmed Al Ahmadi, has stepped down from his role. He will also no longer be a member of the Board of Directors.

Badr Al-Olama, Chairman of Shuaa, said, “The MCB tranches represent an opportunity for shareholders and investors to take part in the next chapter of our growth story. I am confident that as Shuaa continues to grow and execute its strategy, the value we create will lead to significant returns for all stakeholders.”

The bond conversion price of Dh0.32 per share reflects Shuaa’s improved financial position after a transformative year, according to the company’s statement.

Wafik Ben Mansour, CEO of Shuaa, also spoke about the approval of the MCB tranches, calling it a key moment in the company’s journey to reach its full potential. He said, “This is the final step of a well-planned strategy to strengthen our financial foundation and set the stage for growth and profitability.”

#trending #latest #Shuaa #DubaiInvestment #ConvertibleBonds #Restructuring #ShuaaRestructuring #DFM #StockMarket #BusinessGrowth #FinancialStrength #InvestmentOpportunity #ShuaaGrowth #BondsIssuance #CorporateRestructuring #FinancialRecovery #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

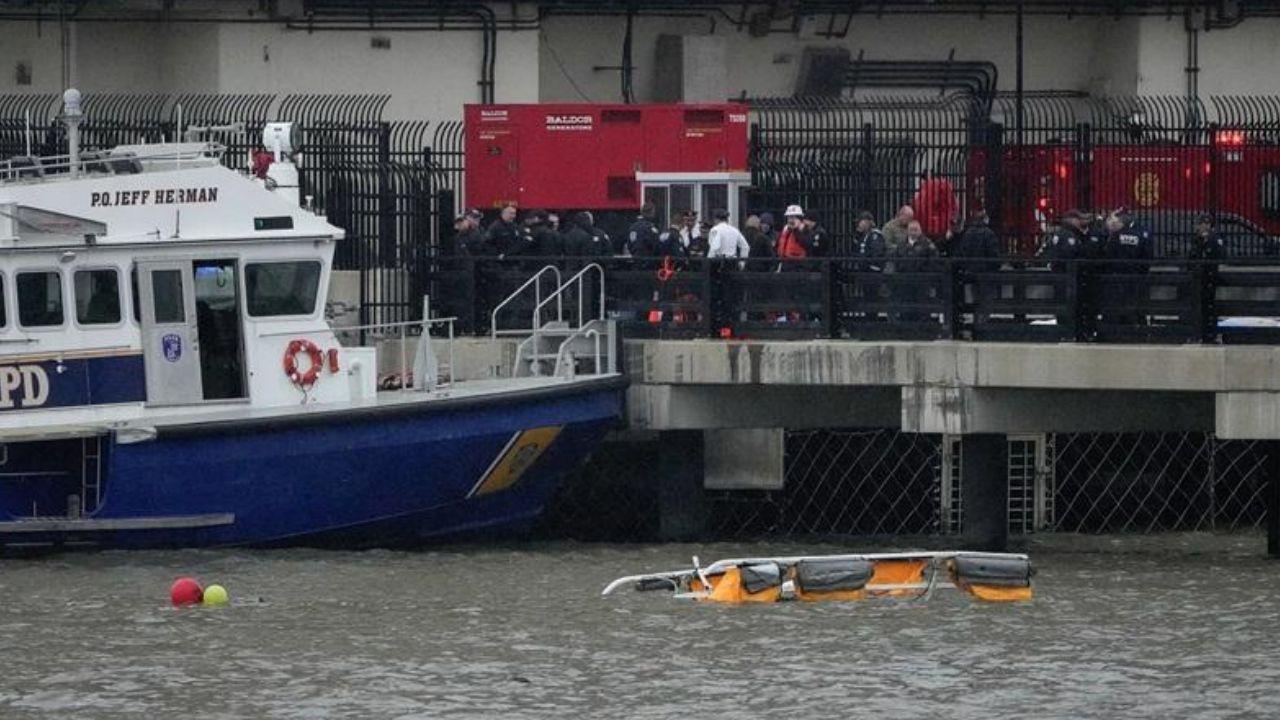

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc