Post by: Layla Badr

Photo: Sharjah Government Media Bureau

His Highness Sheikh Dr. Sultan bin Mohammed Al Qasimi, the Supreme Council Member and Ruler of Sharjah has announced a new law that focuses on taxing companies involved in both extractive and non-extractive natural resources in the Emirate of Sharjah.

Corporate Tax for Extractive Companies

The law outlines that companies involved in extractive activities, like oil and gas extraction, will be taxed at a rate of 20%. This tax will be based on the taxable base, which is calculated according to agreements between the company and the Oil Department. The taxable base will depend on the company’s share of the value of the oil and gas it produces. This amount is calculated by dividing the total royalty and any agreed-upon participation in the division between the Oil Department and the company.

For extractive companies, royalties, bonuses, and annual rent for any concession area they operate in will be set according to the agreements made between the Oil Department and the companies.

Corporate Tax for Non-Extractive Companies

Non-extractive companies that deal with other natural resources will also face a 20% corporate tax. This tax will be calculated based on the company's net taxable profits each year, after necessary adjustments. These adjustments may include:

Depreciation of assets: Companies can deduct the depreciation of their assets from the taxable base. Non-current assets will be depreciated at 20% each year. If the company follows an international standard for preparing its financial statements, it can also deduct the depreciation amount as shown in its financial statements, as long as the finance department approves it.

Tax losses: Companies can carry forward any tax losses to later periods and deduct them from the taxable base for those years.

Tax Deductions for Direct Taxes

The law allows companies to deduct the direct federal taxes they have already paid. If they have paid any kind of direct tax under federal law, they can subtract this from the tax they owe under this new law.

Tax Payment Procedures

Companies must follow specific procedures to pay their taxes:

Extractive Companies: These companies must pay their tax amount directly to the Oil Department based on the agreement they have with them.

Non-Extractive Companies: These companies must pay the tax to the finance department. The payment must be made no later than the last day of the ninth month following the end of the financial year.

If a company fails to pay the tax on time, a 1% penalty will be added for every 30 days of delay until the tax is fully paid.

Audits and Reports

The finance department has the right to audit the records and documents of companies to ensure the accuracy of their tax payments. After completing the audit, the finance department will issue a report stating the tax amount due. If a company owes any additional taxes, they must pay within 15 days after receiving the report. If the company does not pay the outstanding taxes, a 2% penalty will be added for every 30 days of delay.

If the audit reveals that a company intentionally tried to avoid paying taxes, a 5% penalty will be imposed on the total tax due.

Appeals Process

If a company disagrees with the tax decisions made, they have the right to file an objection. Extractive companies can submit their objections to the Oil Department, while non-extractive companies should submit theirs to the finance department. The objection must be submitted within 20 days of receiving the tax decision. The department will issue a decision within 15 days of receiving the objection.

If a company disagrees with the decision made, it can appeal further to a committee formed by the finance department. The committee will review the case and make a final decision within 15 days.

Compliance and Record Keeping

To maintain compliance with the law, companies must pay their due taxes to renew their commercial licenses and concession rights in Sharjah. Companies are also required to keep records and supporting documents for 7 years, making it easier for the Oil Department or the finance department to access them during an audit. If a company is liquidated, it must submit a final tax declaration within 90 days of stopping its operations.

Confidentiality of Submissions

The law ensures that all information submitted by companies for tax purposes remains confidential. Only the necessary departments involved in audits or reviews will have access to this information.

This new law will have a significant impact on companies operating in Sharjah, ensuring that taxes are fairly applied to both extractive and non-extractive natural resource industries.

#trending #latest #Sharjah #CorporateTax #NaturalResources #TaxLaw #ExtractiveCompanies #NonExtractiveCompanies #OilDepartment #FinanceDepartment #TaxCompliance #SharjahLaw #TaxPayment #TaxAudit #TaxAppeals #TaxDeductions #TaxPen #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Cosmin Olăroiu signs a 2-year deal as UAE football coach, replacing Paulo Bento ahead of key 2026 World Cup qualifier matches....Read More.

Two Telangana men killed by a colleague in Dubai last week were brought back home. Their bodies arrived in Hyderabad on Saturday and were received by relatives...Read More.

Humanoid Robots Race with Humans at Half-Marathon in China

21 humanoid robots raced alongside runners in the Yizhuang half-marathon, showcasing robotic enginee

Woman Brain-Dead After Paris Cryotherapy Accident

A woman is brain-dead after a fatal cryotherapy accident in Paris that also claimed a gym worker’s l

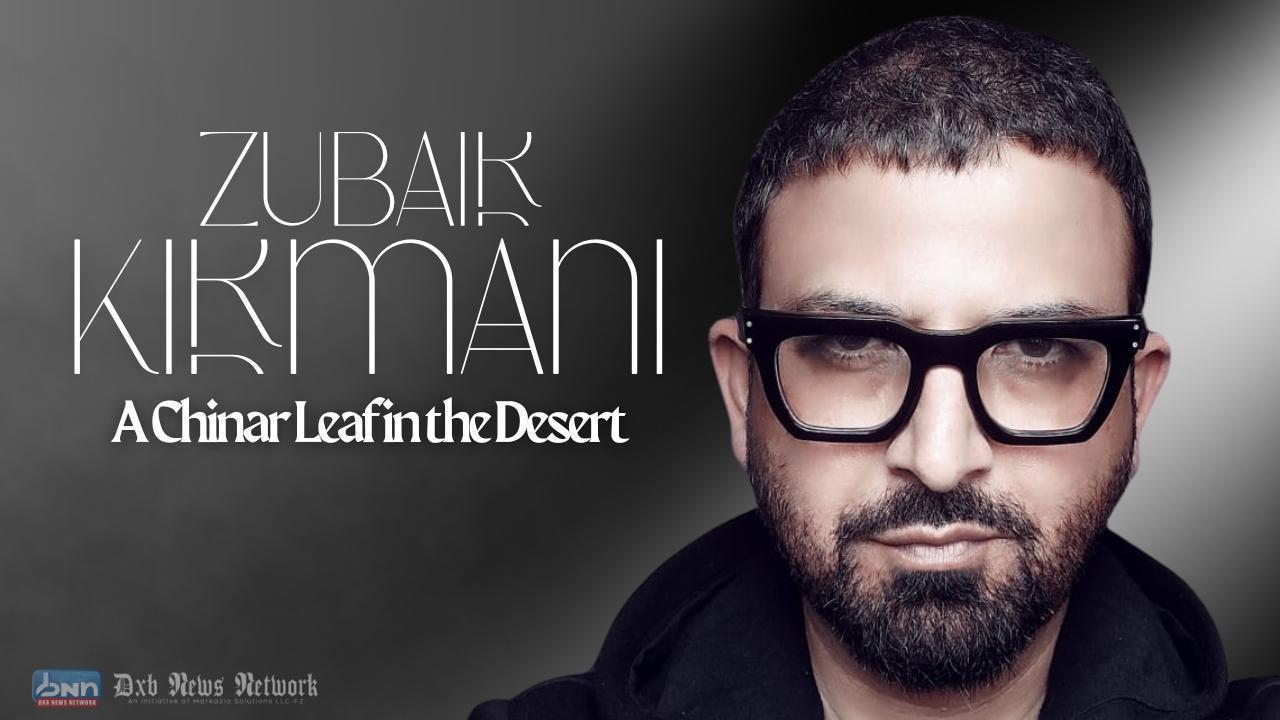

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

A Chinar Leaf in the Desert: Zubair Kirmani and the Journey of Kashmir at World Art Dubai

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Carla Gía Brings the Language of Duality to World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025

Not Just a Painting, It’s a Pulse: Deena Radhi at World Art Dubai 2025