Post by: Dr. Amrinder Pal Singh

Photo : Moneycontrol

The Indian Venture and Alternate Capital Association (IVCA) has reportedly appealed to the Reserve Bank of India (RBI) to impose exposure limits on Non-Banking Financial Companies (NBFCs) investing in Alternative Investment Funds (AIFs), as informed by several sources to Moneycontrol. This initiative stems from concerns regarding the independence of investment decision-making in certain AIFs, particularly those with a significant portion of their corpus sourced from NBFCs. Such AIFs are observed to engage in a high volume of related-party transactions, reinvesting funds into their own group entities, sources added.

At present, while banks and insurance companies are restricted to investing not more than 10 percent of their total corpus in AIFs, no such limitation applies to NBFCs. Two years ago, the RBI had introduced phased regulations for NBFCs, and industry insiders now propose extending these regulations to encompass NBFCs' investments in AIFs.

Stay informed with the latest news. Follow DXB News Network on WhatsApp Channel

The IVCA has also outlined suggestions on how exposure limits could be determined for different types of NBFCs. Siddharth Pai, the co-chair of the regulatory affairs committee at IVCA, proposed, "Depending on the type and investment strategy, exposure limits for NBFCs investing in AIFs could be decided. If it is a deposit-taking NBFC, then a lower exposure limit, and if it is an NBFC making equities investments, it could have a higher exposure limit."

The recommendation aims to curtail related-party transactions between AIFs and NBFC group entities, sources disclosed. A member of the IVCA highlighted that financial groups often comprise both an NBFC and an AIF within their conglomerate. In the absence of exposure limits for NBFCs investing in AIFs, certain AIFs tend to allocate a significant portion of their funds to their own NBFC, which is deemed undesirable.

"AIFs are considered to be third-party managers who invest independently and maintain conflict-of-interest resolution mechanisms between the fund and the group company. To reduce related-party transactions between group entities and the fund, non-group investors must have a greater representation on fund decisions," Pai emphasized.

The objective behind imposing exposure limits on NBFCs is to ensure greater independence in decision-making by the AIF fund and address concerns related to concentration and interconnected transactions, according to Pai.

While there has been no response from the central bank yet, discussions have reportedly taken place between the association and the RBI on this matter. Additionally, consultations with other stakeholders are underway, as mentioned by another individual from the industry body.

In December 2023, the RBI issued a circular for Regulated Entities (RE) regarding investments in AIFs, which stipulated certain guidelines:

1) REs should refrain from investing in AIF schemes indirectly linked to companies to which they have extended loans in the past year.

2) If an AIF, in which a bank or financial institution has invested, makes further investments in one of their borrower companies, the bank or institution must divest its investment in that AIF within 30 days.

3) In case they are unable to sell within 30 days, they must set aside 100 percent of the value of that investment.

Recently, there has been a relaxation in the 100 percent provision rule, whereby lenders need to provide for only the amount the AIF invested in the borrower company, rather than the entire amount invested in the AIF.

#trending #latest #IVCA #RBI #NBFC #AIF #Investments #Regulation #FinancialMarkets #AlternativeInvestments #ReserveBankOfIndia #Finance #CapitalManagement #Banking #Economy #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

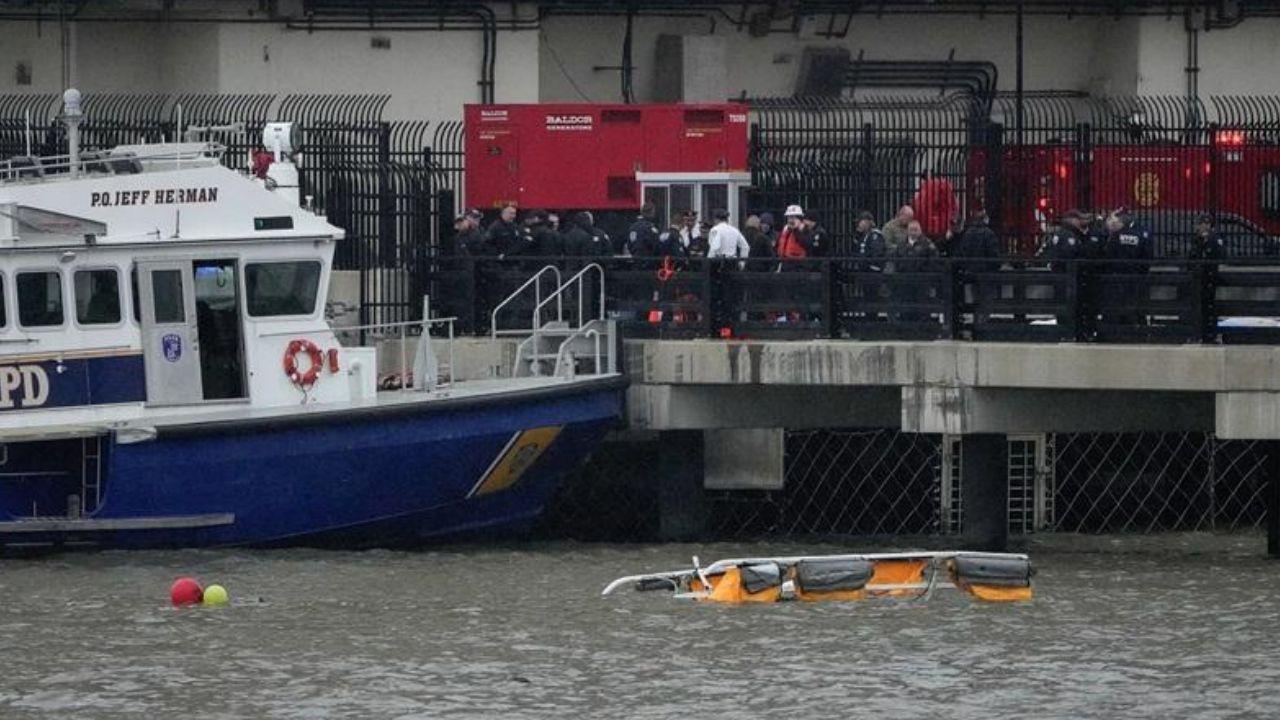

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc