Post by: Vansh Kumar

Living under the burden of debt can be stressful, affecting both your financial and mental well-being. The good news is that you can live debt-free with the right strategies and discipline. Achieving financial freedom doesn’t happen overnight, but by taking small, consistent steps, you can eliminate debt and build a secure future. Whether you're struggling with credit card bills, student loans, or mortgages, this guide will help you take control of your finances and create a debt-free life.

The first step to live debt-free is understanding your current financial situation. Gather all your financial statements, including credit card balances, loans, and other debts. Make a list of the total amount you owe, interest rates for each debt, and monthly payments required. This will give you a clear picture of where you stand and help you develop an effective repayment plan.

A well-structured budget is essential for achieving financial freedom. Track your income and expenses to see where your money is going. Prioritize essentials like rent, utilities, and groceries, and cut down on unnecessary expenses. Use budgeting apps or spreadsheets to stay on track. A successful budget will help you allocate more funds toward paying off debt while ensuring you meet your daily needs.

There are two popular debt repayment strategies to help you live debt-free. The Debt Snowball Method focuses on paying off the smallest debts first while making minimum payments on larger debts. Once a small debt is cleared, move to the next one. This method provides motivation as you see quick progress. The Debt Avalanche Method focuses on paying off debts with the highest interest rates first. This saves more money in the long run as you reduce costly interest payments. Choose a method that works best for your situation and stick to it consistently.

Earning extra income can accelerate your journey to financial freedom. Consider side hustles such as freelancing, tutoring, or selling handmade products. If possible, negotiate a raise at work or look for higher-paying job opportunities. The more income you generate, the faster you can clear your debts.

Small lifestyle changes can make a big difference in your finances. Cooking meals at home instead of eating out, canceling unused subscriptions and memberships, using public transportation or carpooling to save on fuel, shopping during sales and using discount coupons, and reducing impulse spending by waiting 24 hours before making a purchase are simple adjustments that will help you save more money and allocate it toward debt repayment.

An emergency fund acts as a financial safety net, preventing you from relying on credit cards or loans during unexpected situations. Start by saving at least three to six months’ worth of expenses. Even setting aside a small amount each month can help you stay on track to live debt-free.

If you must use credit, do so responsibly. Pay off credit card balances in full each month to avoid interest charges. Avoid unnecessary loans and only borrow for essential needs, such as education or home purchases. Responsible credit use ensures you maintain financial stability while working toward financial freedom.

If managing debt feels overwhelming, consider consulting a financial advisor. They can provide tailored strategies to help you pay off debt efficiently and develop a sustainable financial plan. Many nonprofit organizations also offer free or low-cost debt counseling services.

Becoming debt-free requires dedication and persistence. Set small, achievable goals and celebrate milestones along the way. Whether it's paying off a credit card or saving your first $1,000, acknowledging progress will keep you motivated.

Living under debt can be overwhelming, but with the right strategies, you can achieve financial freedom. The key to a debt-free life starts with understanding your financial situation by listing all your debts, interest rates, and monthly payments. Creating a realistic budget helps manage expenses, while adopting effective repayment strategies like the Debt Snowball or Debt Avalanche method ensures steady progress. Increasing income through side hustles, cutting unnecessary expenses, and building an emergency fund provide financial security. Responsible credit usage and seeking professional financial advice can also help you stay on track. Staying motivated and celebrating small achievements along the way will keep you committed to your debt-free journey.

This article is for informational purposes only and does not constitute financial advice. Readers should consult a certified financial expert before making any major financial decisions. DXB News Network is not responsible for any financial outcomes resulting from actions taken based on this article.

#trending #latest #DebtFree #FinancialFreedom #MoneyManagement #SaveMoney #BudgetingTips #DebtRepayment #FinancialPlanning #SmartSpending #EmergencyFund #WealthBuilding #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

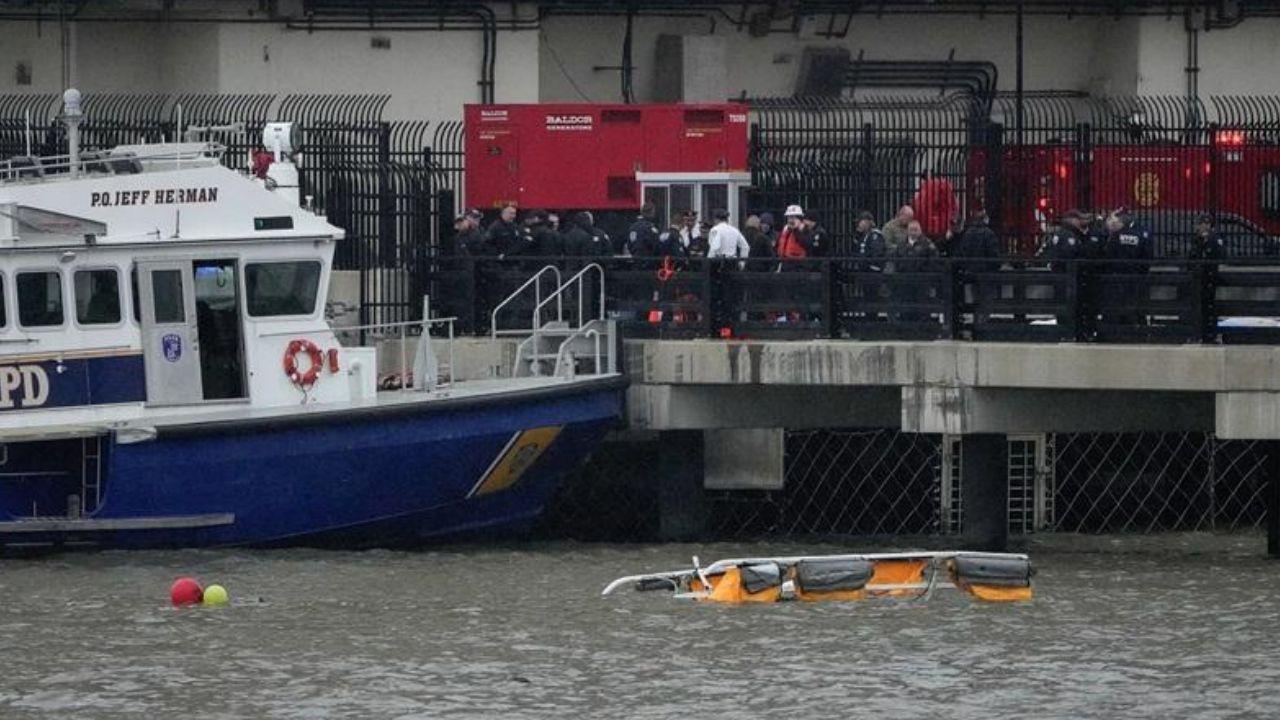

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc