Managing money wisely is one of the most crucial life skills that can determine your financial success and stability. Essential personal finance tips for a secure future can help you build wealth, avoid debt, and achieve financial freedom. Whether you are just starting or looking to improve your financial habits, understanding how to budget, save, and invest can set you on the right path. In this guide, you will discover key strategies to manage your money effectively and secure a bright financial future.

One of the foundational steps in financial planning is creating a budget. A well-structured budget helps you track your income and expenses, ensuring that you live within your means. Start by listing all sources of income and categorizing your expenses, including fixed costs like rent and utilities, and variable expenses like entertainment and dining out. The 50/30/20 rule is a great guideline—allocate 50% of your income for necessities, 30% for wants, and 20% for savings or debt repayment. Sticking to a budget allows you to avoid unnecessary spending and prioritize financial stability.

Unexpected expenses can arise at any time, and having a financial safety net can prevent stress and debt. An emergency fund is a savings account that covers three to six months' worth of living expenses. This fund ensures that you can handle medical emergencies, job loss, or unexpected repairs without relying on loans or credit cards. Start small by setting aside a portion of your income each month, and gradually build your savings over time. Keeping your emergency fund in a high-yield savings account can also help it grow while remaining easily accessible.

Debt can be a major obstacle to financial security if not managed properly. High-interest debts, such as credit card balances, can quickly accumulate and become overwhelming. To regain control, prioritize paying off debts using methods like the avalanche or snowball strategy. The avalanche method focuses on paying off high-interest debts first, while the snowball method involves paying off smaller debts first to build momentum. Avoid taking on unnecessary loans and always make timely payments to maintain a good credit score, which can benefit you in future financial endeavors.

Saving money is important, but investing is what helps your wealth grow over time. Understanding different investment options such as stocks, bonds, mutual funds, and real estate can help you make informed decisions. Diversifying your investments reduces risk and ensures a steady return over time. If you’re new to investing, consider seeking advice from a financial advisor or using online investment platforms. The key is to start early and remain consistent, as compound interest can significantly boost your wealth in the long run.

It’s never too early to start thinking about retirement. The earlier you begin, the more time your investments have to grow. Contributing to retirement accounts like a 401(k) or an IRA allows you to build a strong financial cushion for your future. Many employers offer matching contributions to retirement accounts, which is essentially free money for your savings. Automating your contributions ensures consistency and helps you stay on track for a comfortable retirement.

Many people spend more than they realize on non-essential items. Reviewing your spending habits can help you identify areas where you can cut back and save more. Simple changes like cooking at home instead of eating out, canceling unused subscriptions, and shopping smarter can add up over time. Being mindful of your spending does not mean sacrificing your quality of life—it simply means making better financial choices that align with your long-term goals.

Relying on a single source of income can be risky, especially in uncertain economic times. Exploring additional income streams, such as freelancing, starting a side business, or investing in rental properties, can provide financial stability. Passive income sources, such as dividends, royalties, or affiliate marketing, can also contribute to long-term wealth. By diversifying your income, you can build a more secure financial future and have more financial freedom.

Financial literacy is a lifelong journey. Staying informed about financial trends, investment strategies, and money management techniques can help you make better decisions. Reading books, taking online courses, or following financial experts can provide valuable insights. The more you educate yourself about personal finance, the more empowered you will be to take control of your financial future.

Summary: Managing money wisely is key to achieving financial security and long-term stability. In the article Essential Personal Finance Tips for a Secure Future, readers learn practical ways to budget effectively, save consistently, and invest wisely. By cutting unnecessary expenses, setting clear financial goals, and understanding debt management, individuals can build wealth over time. The article also highlights the importance of emergency funds and retirement planning to ensure financial freedom. With disciplined financial habits and smart decision-making, anyone can secure a stable future and avoid financial stress.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Readers are encouraged to consult with a certified financial expert before making any financial decisions. DXB News Network is not responsible for any financial outcomes based on the information provided.

#trending #latest #PersonalFinance #MoneyManagement #FinancialFreedom #SmartSaving #WealthBuilding #BudgetingTips #SecureFuture #InvestmentPlanning #DebtFree #FinancialSuccess #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Top Dream Destinations for Your Unforgettable Friends Trip!...Read More.

Explore Why Cash is Still King Despite Digital Payment Growth...Read More.

Baidu launches 2 free AI models to rival DeepSeek in China

Baidu launches 2 free AI models to rival DeepSeek in China

Baidu announced that its new X1 reasoning model and Ernie 4.5 foundation model are now on Ernie Bot

ITC Abu Dhabi converts Bus Service No. 65 into eco-friendly green service

ITC Abu Dhabi converts Bus Service No. 65 into eco-friendly green service

This underscores the need for eco-friendly transport solutions to serve many passengers while ensuri

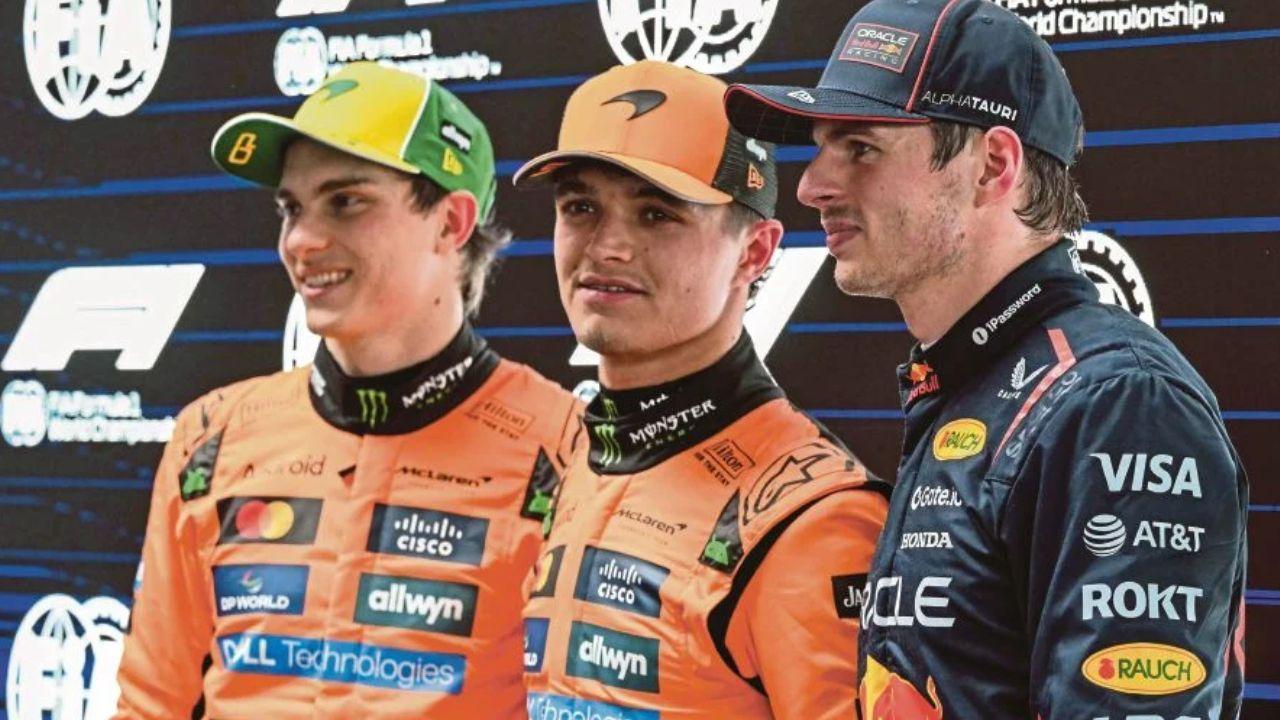

Lando Norris takes pole at Australian GP, McLaren challenges Red Bull

Lando Norris takes pole at Australian GP, McLaren challenges Red Bull

Lando Norris secures pole position in Australian Grand Prix qualifying, leading the grid

UAE’s Etihad-SAT satellite successfully launches into space

UAE’s Etihad-SAT satellite successfully launches into space

Etihad-SAT, the UAE's first SAR satellite, launched on SpaceX's Falcon 9 from California at 10:43 am

State Security Court gives life sentences, fines to 'Bahlol Gang' members

State Security Court gives life sentences, fines to 'Bahlol Gang' members

Abu Dhabi court sentences Bahloul Gang members to prison, fines, and asset confiscation

Dream Destinations for Your Next Friends Trip

Top Dream Destinations for Your Unforgettable Friends Trip!

Why Cash Is Still King: The Benefits of Using Physical Money

Explore Why Cash is Still King Despite Digital Payment Growth

The Latest Apple Gadgets You Need to Know About in 2025

Top Apple Gadgets You Need to Know About for Seamless Daily Living

Unlocking the Power of Forgiveness for a Happier Life

How Unlocking the Power of Forgiveness Can Lead to a More Fulfilling Life

Boost Your Confidence with These Easy Beauty Hacks

Enhance your confidence with easy beauty tips for radiant skin.

Essential Nail Care Tips for Healthy and Beautiful Nails

Achieve Healthy and Beautiful Nails with These Essential Nail Care Tips

The Easiest Musical Instruments for New Players

Start Your Music Journey with the Simplest Instruments For Beginners!

Lando Norris Wins Rainy Australian GP, Hamilton Finishes 10th

Lando Norris wins a chaotic, rain-hit Australian GP, holding off Max Verstappen after a late safety car.

World’s Biggest AI Prompt Engineering Contest Opens Registration

The championship gives local and global talents a chance to showcase skills in prompt engineering by creating precise AI instructions for generating unique and

Feed Your Curiosity and Make Learning a Daily Habit

Stay Updated and Grow by Making Learning a Daily Habit

3001E, 30 Floor, Aspin Commercial Tower, Sheikh Zayed Road, Dubai, UAE

+971 52 602 2429

info@dxbnewsnetwork.com

© DNN. All Rights Reserved.