Post by: Luxmi Verma

Investing wisely is one of the best ways to secure your financial future. Smart investing: building a secure financial future is not just about growing your wealth, it’s about making the right choices that protect your financial stability in the long run. With the right approach and knowledge, anyone can learn to invest smartly, even if they’re just starting. This article will guide you through key principles and strategies to build a solid foundation for your financial future.

For many, the goal of investing is to grow their wealth over time. However, smart investing is more than just putting money into stocks, bonds, or real estate. It involves careful planning, research, and patience. By understanding how to invest wisely, you can avoid unnecessary risks, make better decisions, and ultimately build a secure financial future.

The earlier you start investing, the more you benefit from compounding – the process where the returns on your investments start generating their own returns. However, even if you’re starting later in life, it’s never too late to begin making smart investments that will pay off in the years to come.

Before you dive into investing, it’s essential to set clear, achievable financial goals. Ask yourself: What do I want to achieve with my investments? Are you investing for retirement, buying a home, or saving for your children’s education? Your goals will determine how much risk you are willing to take, the types of investments that make the most sense, and your time horizon for achieving those goals.

Short-Term Goals: For goals within the next 1-5 years, you may want to focus on safer investments, such as bonds or a high-yield savings account.

Long-Term Goals: For goals that are 5 years or more down the road, like retirement or building wealth, you may consider more growth-oriented investments such as stocks or mutual funds.

One of the key principles of smart investing is diversification. Diversification means spreading your money across different types of investments to reduce risk. Instead of putting all your money into one stock or bond, you spread it out across a variety of assets, which can help protect you from market volatility.

Stocks: Investing in individual stocks can offer high returns, but they can also be risky. To balance this, you can invest in a mix of companies, industries, and countries.

Bonds: Bonds are often considered safer investments compared to stocks. By buying bonds, you lend money to a company or government in exchange for periodic interest payments.

Real Estate: Property investments can generate steady income and appreciate in value over time.

Mutual Funds and ETFs: These allow you to invest in a basket of different assets, providing instant diversification with a single purchase.

By diversifying your portfolio, you lower the risk of losing all your money if one investment performs poorly.

Every investment comes with some level of risk. Smart investing means understanding the relationship between risk and reward. Typically, investments that offer higher potential returns also come with higher risk. Stocks, for example, have the potential for high returns, but their prices can fluctuate widely in the short term. On the other hand, bonds and savings accounts are safer, but they also offer lower returns.

Before you make an investment, consider:

Your risk tolerance: Are you comfortable with the possibility of losing money, or do you prefer more stability?

Investment time horizon: The longer you can leave your money invested, the more you can typically afford to take risks. If you need access to your funds in the short term, you may want to stick to safer investments.

Understanding your own comfort with risk will help you create an investment strategy that works for you.

Investing is a long-term game, and success doesn’t happen overnight. One of the most important habits of smart investing is consistency. Even small, regular contributions to your investment portfolio can add up over time. Consider setting up automatic contributions to your retirement account or investment fund. This can help you stay on track and ensure that you’re consistently investing, regardless of market conditions.

Patience is also key. Avoid trying to time the market by buying and selling based on short-term fluctuations. Instead, focus on your long-term goals and allow your investments to grow over time.

The world of investing is constantly changing. New investment opportunities, technologies, and trends emerge regularly. To be a successful investor, it’s important to keep learning and stay informed about market conditions, new products, and strategies.

Read financial news: Stay updated with reputable sources like financial magazines, websites, and news outlets.

Take courses or attend seminars: Many financial experts offer free or affordable courses to help you deepen your knowledge of investing.

Consult a financial advisor: If you’re unsure about where to start or want personalized guidance, consider working with a certified financial planner or advisor.

As your financial situation and goals evolve, so should your investment strategy. It’s important to regularly review your portfolio to ensure it still aligns with your objectives. For example, as you get closer to retirement, you may want to reduce risk by shifting some of your investments from stocks to bonds or other safer assets.

Annual review: At least once a year, check the performance of your investments, rebalance your portfolio, and make adjustments as necessary.

Life changes: Major life events, like a career change, marriage, or the birth of a child, can affect your financial goals and risk tolerance. Be sure to reassess your investment strategy accordingly.

The article titled "Smart Investing: Building a Secure Financial Future" outlines key strategies for successful investing, emphasizing the importance of clear financial goals, diversification, understanding risk and reward, consistency, and ongoing learning. It encourages readers to diversify their investments across stocks, bonds, real estate, and mutual funds to reduce risk. It also stresses the importance of patience and regular portfolio reviews to ensure investments align with long-term financial goals. By following these steps, anyone can take control of their finances and work towards a secure financial future.

This article is provided by DXB News Network for informational purposes only. It does not serve as financial advice and should not replace consultation with a licensed financial advisor. Readers are encouraged to seek personalized guidance from qualified professionals before making investment decisions. DXB News Network is not responsible for any actions taken based on the information provided in this article. Always conduct your own research and consider your individual financial situation before making investment choices.

#trending #latest #SmartInvesting #FinancialFuture #InvestmentTips #DiversifyYourPortfolio #WealthBuilding #InvestingForBeginners #FinancialGoals #SecureFuture #LongTermInvesting #InvestmentStrategies #MoneyManagement #PersonalFinance #FinancialIndependence #InvestmentSuccess #BuildingWealth #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

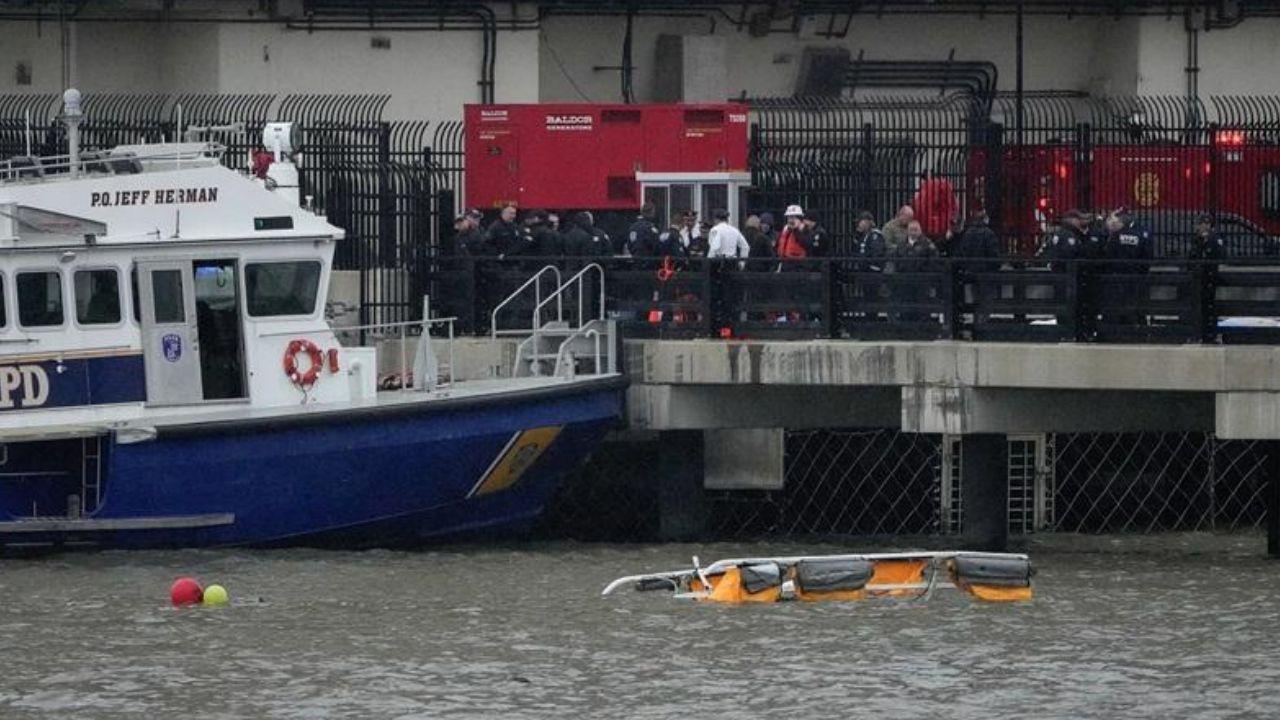

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc