Post by: Vansh Kumar

As we step into 2025, it’s the perfect time to reassess your Financial plan and set a solid foundation for a prosperous year. Whether you're looking to save more, invest smarter, or just gain better control over your finances, small adjustments can make a significant impact. Here are 8 simple ways to start 2025 financially smart that will help you achieve your goals and boost your financial health throughout the year.

The first step toward financial success is creating a budget. Budgeting helps you understand where your money is going and allows you to allocate funds for your essential needs, savings, and discretionary spending. In 2025, make sure your budget is realistic—consider changes in income, lifestyle, or any new goals. By sticking to your budget, you can avoid overspending and ensure you’re saving for the future.

Life is unpredictable, and an emergency fund can provide financial security during unexpected events. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. Starting 2025 with a solid emergency fund will give you peace of mind and prevent financial setbacks in case of an emergency. Even if it’s just a small amount each month, the key is consistency.

Debt can be a significant barrier to financial freedom. In 2025, focus on paying down high-interest debt first, such as credit cards or personal loans. Once the high-interest debts are managed, you can work on paying off other loans more comfortably. Consider the "debt snowball" method, which encourages paying off smaller debts first to gain momentum, or the "debt avalanche" method, where you focus on the debt with the highest interest rate first.

Even if retirement seems far off, starting early can make a huge difference. Retirement savings allow your money to grow over time, thanks to compound interest. Set a goal to contribute to retirement accounts like 401(k)s or IRAs in 2025. If your employer offers a matching contribution, try to contribute enough to take full advantage of this benefit—it’s essentially free money for your future!

Automation is a great way to stay on top of your finances without having to think about it constantly. Set up automatic transfers for savings and investments so that a portion of your income is automatically allocated toward your financial goals. Whether it’s for an emergency fund, retirement, or investment accounts, automating ensures you stick to your plan and consistently work toward building your wealth.

In order to understand where your money is going, tracking your expenses is crucial. You can do this manually by recording all your purchases or by using financial tracking apps that categorize and summarize your expenses. Tracking helps you identify areas where you can cut back or adjust, allowing you to make smarter decisions. By tracking your spending, you can keep your budget on track and avoid financial surprises.

Financial literacy is one of the most important skills you can develop. Spend time in 2025 learning about personal finance topics, such as investing, taxes, and wealth management. The more informed you are, the better financial decisions you can make. You don’t have to attend expensive seminars—there are plenty of free resources online, including blogs, podcasts, and YouTube channels dedicated to finance. As you learn, you'll feel more confident in managing your money.

Setting clear, achievable financial goals will give you a roadmap to follow in 2025. Whether you want to save for a vacation, buy a home, or eliminate debt, having specific goals will keep you motivated. Break your goals into smaller, manageable steps, and track your progress along the way. Revisit your goals periodically and adjust them as necessary. By the end of the year, you’ll be amazed at how much you’ve accomplished.

Summary: In this article, we explore 8 simple ways to start 2025 financially smart. By focusing on key financial habits like creating a budget, building an emergency fund, paying down debt, and saving for retirement, you can lay the foundation for a secure financial future. Automating savings, tracking expenses, improving financial literacy, and setting clear financial goals are also essential steps in building long-term wealth. These practical tips will help you make consistent progress toward achieving your financial goals throughout the year.

Disclaimer: This content is provided by DXB News Network for informational purposes only. It is always recommended to consult with a certified financial advisor for personalized financial advice and planning.

#trending #latest #SmartFinance #FinancialTips #2025Goals #MoneyManagement #Budgeting #SaveSmart #FinancialSuccess #WealthBuilding #InvestSmart #DebtFreeJourney #FinancialPlanning #SecureFuture #MoneyGoals #FinanceTips #breakingnews #worldnews #headlines #topstories #globalUpdate #dxbnewsnetwork #dxbnews #dxbdnn #dxbnewsnetworkdnn #bestnewschanneldubai #bestnewschannelUAE #bestnewschannelabudhabi #bestnewschannelajman #bestnewschannelofdubai #popularnewschanneldubai

Hania Aamir stuns in Mahima Mahajan lehenga at a wedding, glowing like a desi princess in soft ivory and pink with mirror work....Read More.

Sushmita Sen stuns at fashion event with daughters and Rohman, flaunting elegant pearls and huge diamond rings. Her stylish look steals the spotlight....Read More.

Millie Bobby Brown explores Dubai in new campaign

Millie Bobby Brown stars in a fun Dubai film with Jake Bongiovi, sharing her journey through city st

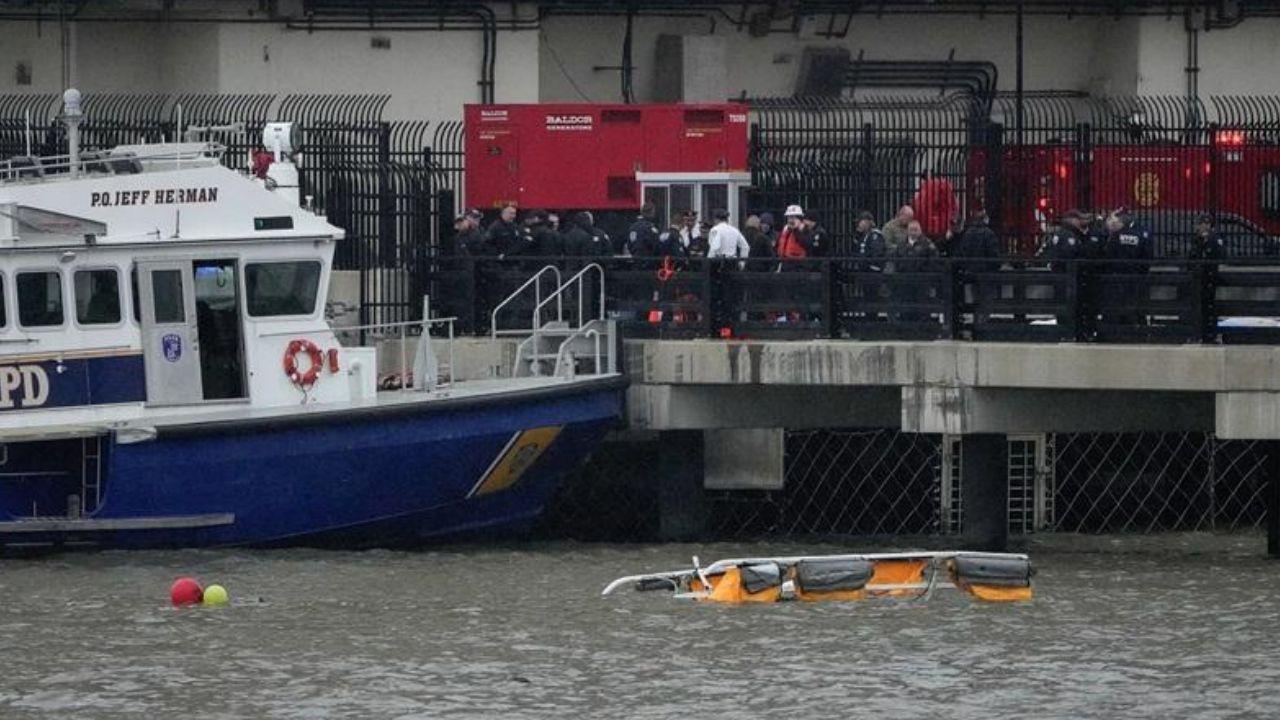

6 Killed in Helicopter Crash in Hudson River, NYC – Mayor Adams

A helicopter crash in NYC's Hudson River killed 6, including 3 kids. The victims were tourists from

Sheikh Hamdan Meets ICC Chief & Indian Cricketers in Mumbai

Sheikh Hamdan meets Jay Shah, Rohit Sharma & others in Mumbai, boosting UAE-India sports ties and cr

UAE, Indonesia boost ties with key deals in Abu Dhabi

UAE and Indonesia leaders met in Abu Dhabi, signing deals to grow ties in economy, energy, and food

Lewandowski Scores Twice as Barcelona Beat Dortmund

Barcelona dominate Dortmund 4-0 in Champions League, with Lewandowski scoring two goals to give Barc